Carola Binder

Associate Professor

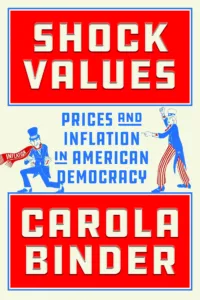

Carola Binder is a macroeconomist and economic historian with a PhD from the University of California, Berkeley. She is the author of the book Shock Values: Prices and Inflation in American Democracy (University of Chicago Press, 2024) and numerous articles on monetary policy and inflation expectations. She is on the editorial board of the American Economic Review and an associate editor at the Review of Economics and Statistics, the Journal of Money, Credit, and Banking, and Explorations in Economic History. She is a Research Associate in the Monetary Economics program at the National Bureau of Economics Research and a senior affiliated scholar at the Mercatus Center. She also serves on the advisory panel of the Catholic Research Economists Discussion Organization. Before joining UT SCL, she taught at Haverford College from 2015 through 2024.

EDUCATION

Ph.D. in Economics from the University of California, Berkeley

Macroeconomics, Monetary Policy, Economic History

“The Rise of Inflation Targeting” (forthcoming), Southern Economic Journal.

2025

“Monetary Policy and House Price Expectations” (with Pei Kuang and Li Tang), Journal of the European Economic Association.

“The Effects of Inflation Uncertainty on Firms and the Macroeconomy” (with Ezgi Ozturk and Simon Sheng), Journal of International Money and Finance.

“Automated Detection of Emotion in Central Bank Communication: A Warning” (with Nicole Baerg), National Institute Economic Review.

2024

“Partisan Expectations and COVID-Era Inflation” (with Rupal Kamdar and Jane Ryngaert), Journal of Monetary Economics.

“Consumer Inflation Expectations: Daily Dynamics” (with Jeffrey Campbell and Jane Ryngaert), Journal of Monetary Economics.

“Central Bank Forecasting: A Survey” (with Rodrigo Sekkel), Journal of Economic Surveys.

2023

“Laboratories of Central Banking” (with Christina Skinner), Review of Banking and Financial Law.

“Gas Price Expectations of Chinese Households” (with Zidong An and Simon Sheng), Energy Economics.

“Federal Reserve Legitimacy” (with Christina Skinner), Stanford Journal of Law, Business & Finance.

“Learning-through-Survey in Inflation Expectations” (with GwangMin Kim), American Economic Journal: Macroeconomics.

2022

“Expected and Realized Inflation in Historical Perspective” (with Rupal Kamdar), Journal of Economic Perspectives.

“Out of Bounds: Do SPF Respondents Have Anchored Inflation Expectations?” (with Wesley Janson and Randal Verbrugge), Journal of Money, Credit, and Banking.

“Inflation Expectations and Consumption: Evidence from 1951” (with Gillian Brunet), Economic Inquiry.

“Time-of-Day and Day-of-Week Variations in Amazon Mechanical Turk Survey Responses”, Journal of Macroeconomics.

“The Term Structure of Uncertainty: New Evidence from Survey Expectations” (with Xuguang Sheng and Tucker McElroy), Journal of Money, Credit, and Banking.

2021

“Household Expectations and the Release of Macroeconomic Statistics”, Economics Letters.

“Central Bank Communication and Disagreement about the Natural Rate Hypothesis”, International Journal of Central Banking.

“Presidential Antagonism and Central Bank Credibility”, Economics and Politics.

“Political Pressure on Central Banks”, Journal of Money, Credit, and Banking.

2020

“Stuck in the Seventies: Gas Prices and Consumer Sentiment.” (with Christos Makridis), Review of Economics and Statistics.

“Coronavirus Fears and Macroeconomic Expectations”, Review of Economics and Statistics.

“Long-Run Inflation Expectations in the Shrinking Upper Tail”, Economics Letters.

2019

“Inequality and the Inflation Tax”, Journal of Macroeconomics.

“Comment on ‘Central Bank Announcements: Big News for Little People?’ by Michael Lamla and Dmitri Vinogradov”, Journal of Monetary Economics.

2018

“Inflation Expectations and the Price at the Pump”, Journal of Macroeconomics.

“Household Informedness and Anchoring Expectations: Experimental Evidence.” (with Haverford student Alex Rodrigue), Southern Economic Journal.

“Inequality, Redistribution, and the Individualism-Collectivism Dimension of Culture”, Social Indicators Research.

“The FOMC versus the Staff, Revisited: When do Policymakers Add Value?” (with Haverford student Samantha Wetzel), Economics Letters.

2017

“Federal Reserve Communication and the Media”, Journal of Media Economics.

“Interest Rate Prominence in Consumer Decision-Making”, Economic Inquiry.

“Consumer Forecast Revisions: Is Information Really So Sticky?”, Economics Letters.

“Measuring Uncertainty Based on Rounding: New Method and Application to Inflation Expectations.”, Journal of Monetary Economics.

“Fed Speak on Main Street: Central Bank Communication and Household Expectations.”, Journal of Macroeconomics.

“Economic Policy Uncertainty and Household Inflation Uncertainty”, B.E. Journal of Macroeconomics.

2016

“Estimation of Historical Inflation Expectations”, Explorations in Economic History.

2015

“Whose Expectations Augment the Phillips Curve?”, Economics Letters.

Spring 2025

CIV 303K Democracy and Capitalism

Fall 2025

CIV 303K Democracy and Capitalism

UGS 302 Inflation in America

Fall 2024

UGS 302 Inflation in America